Is ServiceNow Stock Headed for a Significant Rally? What Investors Should Know.

/ServiceNow%20Inc%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

ServiceNow (NOW) continues to deliver impressive growth. The provider of cloud-based solutions for digitizing and managing enterprise workflows is witnessing strong demand for its artificial intelligence (AI) and customer relationship management (CRM) offerings, which is translating into a growing customer base with larger annual contract values (ACVs).

Yet, despite these strong fundamentals, ServiceNow stock has underperformed broader market indexes this year and remains in the red. This disconnect presents a buying opportunity. The market appears to be overlooking the company’s solid long-term prospects. For instance, its customer growth remains strong, retention rates are high, and current remaining performance obligations (cRPO) — a key metric for future revenue growth — are on the rise.

ServiceNow: AI Demand to Push Stock Higher

Most notably, demand for ServiceNow’s AI-powered platform continues to accelerate, reflecting broader enterprise adoption trends in intelligent workflow automation. Moreover, internally, AI efficiencies are helping the company drive margin expansion.

The strong demand is translating into solid financial performance. In Q2 2025, its subscription revenue rose 21.5% year-over-year to $3.113 billion, while total RPO grew 25.5% year-over-year to nearly $24 billion. The cRPO reached $10.92 billion, up 21.5% in constant currency.

The company also achieved a 98% renewal rate, reflecting the significance of its platform for digital transformation. By the end of Q2, ServiceNow had 528 customers generating over $5 million in ACV, and the number of clients contributing $20 million or more jumped by over 30% year-over-year. The quarter also saw the company close 89 net new ACV deals exceeding $1 million, including 11 deals topping $5 million. Notably, every one of its top 20 deals included five or more products, showcasing growing adoption of multiple products, which will drive average revenue per customer and customer retention.

ServiceNow’s CRM business is another area that’s rapidly gaining traction. The company’s acquisition of Logik.ai is already paying off, especially in its Configure, Price, Quote (CPQ) capabilities, with nine deals closed in June.

The company’s AI-driven offerings are performing exceptionally well. Products like IT Asset Management (ITAM) Now Assist have seen net new ACV surge nearly sixfold quarter-over-quarter, with average deal sizes more than tripling. Other modules, such as Security Operations (SecOps) and risk, are also doubling in ACV growth, and flagship tools like IT Service Management (ITSM) Plus, Customer Service Management (CSM) Plus, and HR Service Delivery (HRSD) Plus are posting exceptional year-over-year gains in value.

The launch of Agentic Workforce Management and the rapid development of new AI infrastructure, such as AI Control Tower and a no-code Agent Studio, position it well for future growth. These new offerings are already experiencing strong demand and generating solid ACV.

Financially, ServiceNow is translating this growth into operational efficiency. Margin expansion is being driven not only by revenue growth, but also by AI-driven cost management.

In short, the solid adoption of its platform and strong pipeline positions it well to deliver $15 billion-plus subscription revenue in 2026, with $1 billion in Now Assist ACV.

What Analysts Recommend for ServiceNow Stock

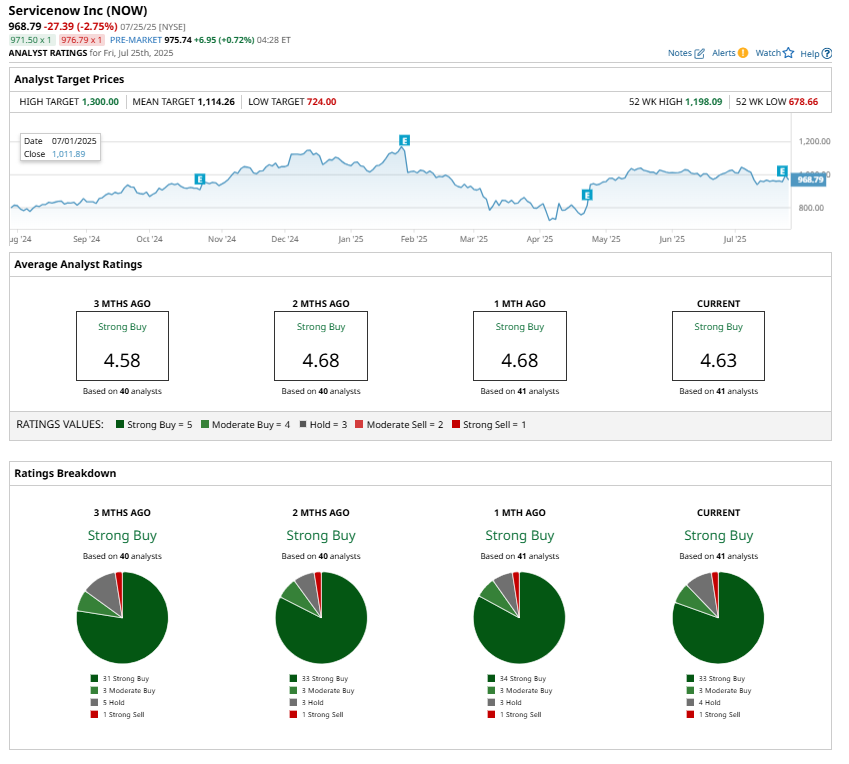

While the stock hasn’t yet caught up to these underlying fundamentals, Wall Street analysts are bullish about its prospects and maintain a “Strong Buy” consensus rating. This suggests that the current market undervaluation may be temporary, and a strong rally could be on the horizon as AI tailwinds continue to drive both top-line growth and operational efficiency.

How High Can ServiceNow Stock Go?

ServiceNow is well-positioned to benefit from accelerating demand for its AI platform, strong customer retention, and expanding contract values. Despite recent underperformance in the stock, the company’s fundamentals remain solid. With analysts maintaining a positive outlook and the broader AI and enterprise automation trends playing in its favor, ServiceNow appears well-positioned for a significant rally.

Analysts have an average price target of $1,114.26, implying about 13% upside potential. Moreover, the highest price target for NOW stock is $1,300, indicating 31% upside potential over the next 12 months.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.